InsureTC.com Insurance Blog |

|

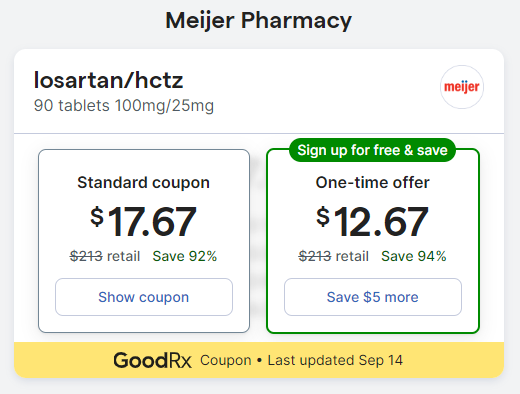

How do you know you're getting the best price for your prescription drugs? Last September my doctor gave me a new prescription. I have a High Deductible HSA plan which means I pay the insurance company's discounted price for my drugs until I meet my deductible. Shortly after my doctor appointment I got a text from the pharmacy that my prescription was ready and my cost was $186.00. I went to https://www.goodrx.com/ and looked up the drug, dosage and quantity. My cost on the website coupon would be $18.00. When I went to the pharmacy I asked them if the price I was texted was my actual discounted price through my insurance. They said it was and I showed them the coupon on my phone and said I would rather do the coupon. I realize that if I pay cash I won't be able to apply that amount to my HSA health plan deductible - but it was worth it to me to not be out the cash since I never meet my deductible anyway. I could still pay for the prescription using money from my HSA bank account. The tech looked at my coupon and said "I can do better than that". She had a coupon on the case register which she scanned. My price $14.00! I asked her where all the money would go if I had paid the $186.00 and she rolled her eyes and said "it's complicated". I suspect that everyone - the pharmacy, the vendor, the health plan and the pharmaceutical company would all get a piece of my action with the "special" price offered through my health plan. In November I got an email from my health plan telling me about a new benefit. The Right Price Program automatically compares coupons, discount programs and my carrier negotiated price and gives me the lowest available without me having to shop and compare myself. I had a test of the program this week. The cost of my prescription was $14.62. I went to goodRx and double checked - their best price for the same dosage, drug and quantity was $17.67. It looks like the new program is working - but I will continue to check the prices. This drug is a generic and the cost is literally pennies a dose. Most available Medicare Advantage plans offer this drug for $0 copay. Even the plans with $0 premium have the $0 tier 1 drug copays at preferred pharmacies. When I get Medicare in 2023 I will continue to check the prices just to keep everyone honest.

The new Inflation Induction Act provides insulins for $35. Select plans have some insulins right now for $0 copay. We will have to see what happens to the free insulin since the law will obviously lower the cost of many of the high priced options - but will big pharma set the floor at $35 to help make up the difference? It will be another thing to watch going forward.

0 Comments

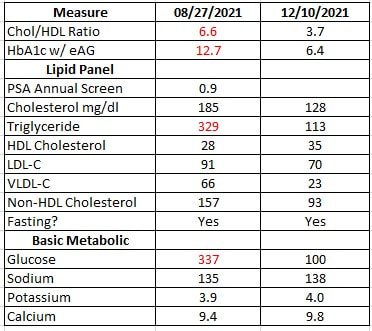

I first had Covid in mid-February, early March of 2020, before there were tests or even masks. In spite of being fully vaccinated with a booster I began to feel sick again on Tuesday and it was an old familiar feeling. I began testing and on Wednesday night my 3rd test came back positive. I started the anti-viral Paxlovid on Thursday afternoon and it is now Saturday morning and I am looking at the beginning of my 3rd day of the 5-day series of pills. My covid symptoms are reduced by about 90%. I would recommend this to anyone but getting the care and medication you need may be a difficult journey. In eleven more months, I will be aging into Medicare so let me share with you some of my recent experience with healthcare in Northern Michigan. 26 Months Ago I met with a client late on Friday February 14th 2020. He had just returned from a cruise and by the following Tuesday I was feeling like I had a cold coming on. I was looking forward to a break from the mid-winter bleak and by Wednesday I was in Orlando with my wife and daughter looking forward to a week of pool time and sunshine. I was also very much having a “cold” by that time. By Saturday my wife and daughter were sick and my sister who came to visit us also got sick. We flew home on 26 February still trying to get over the “cold”. Two weeks later the country went into lockdown and by the third week of March we were pretty much recovered – except for my older sister who had Covid fog for about 10 months and then after all that her toes turned red (covid toe). Without actual tests that was ultimately how we know that we hadn’t been dealing with only a cold. For the next year my number one goal was to not kill anyone. It still is. I meet with people and help with healthcare planning. With masks, spray and sheets of plastic we have thus far been successful in keeping people safe. The government assumes that everyone can simply go online and pick their Obamacare or Medicare or Short-Term coverage. This is not always possible in a land where internet access and computers can be limited. We do our share of phone and internet appointments and communication by email – but will also still do the old fashioned – meeting face to face in the home, office or other location. The state actually deemed our functions essential during the pandemic and we were exempt from the lockdown rules. 14 Months Ago It was a great relief when the vaccine came out in 2021. My wife works in healthcare and my daughter works in a school so they both had vaccines right away. I was the last being fully vaccinated by the end of March. With life returning to normal I thought it was time to get my annual physical so in February researched and found a new primary care physician (PCP) and was surprised to find that I could not meet with him until July. This is not uncommon with the aging demographic in America. Over 10,000 people are aging into Medicare every day and as people get older health needs tend to increase. This pressure on the system will increase for at least another 10 years as baby boomers turn to seniors. Meanwhile I was able to schedule a dental appointment for a routing cleaning. I met with my dentist on April 14th and he asked if my wife complained about my snoring. I said that she had been complaining about it for over 5 years. In fact my primary care had referred me to the Munson Sleep Center twice for a sleep study – but they had never called me to let me know when. I had even gone there to see the rooms and see if I could schedule a time. They told me to wait for their call. It never came. I was using a mouthguard that seemed to help a little bit and I knew he could make me a real one that would probably be more effective – but he wanted me to complete the sleep study first to make sure there were not more serious issues. He referred me to a doctor online in California and I was able to do a virtual visit. He ordered the study and I was sent all the equipment to do it at home. The result was that I had the most severe form of sleep apnea almost constant events while sleeping. The doctor prescribed a CPAP machine which I was also able to order online and follow instructional videos for set-up and use. By May of 2021 I was using the CPAP every night and it was like flipping a switch. Suddenly I no longer needed a mid-afternoon nap. I had energy and a clear head. The burden of using a CPAP machine every night is far outweighed by the benefits. Actually, sleeping and getting REM sleep, dreaming, waking refreshed. This was all out-of-network – not covered or authorized by my High Deductible HMO plan. It did not really matter to me because I was finally getting the care I had needed for years and it would all hit my deductible anyway. The cost of all of it was about $1,000. If I had been able to get care in-network and use their Durable Medical Equipment provider I would have been paying a monthly maintenance fee and my costs to date would be well over $2,000. By going out-of-network and using virtual care services I was able to get a better value for my health care dollar. Health plans and the Federal government call this consumer engagement, something high-deductible plans were designed to encourage. Hospitals in Michigan must have a certificate of need from the state in order to operate in a geographic area. We are rural so we simply do not have the population base to support multiple systems that compete. As a result, our hospitals are monopolies in each of their areas. We are fortunate to have a great community hospital in Traverse City. Many specialists come here to raise families. We have more care options than most rural areas and it has become a flagship operation for the Northwest lower peninsula. 10 Months Ago When I was finally able to meet with my primary care in July, he ordered my blood work and I relayed to him my CPAP experience. He scheduled me for a full physical on September 23rd which I ended up having to reschedule for October 12th. On Friday August 27th I went to have my blood drawn for labs and was surprised to get a call from my PCP office the following Monday. The doctor had an opening for me to see him right away at 4:15pm. Imaging my surprise when I found out I had full blown type II diabetes. It was not borderline. My HbA1c was 12.7, Triglycerides were 329 and fasting glucose was 337. He immediately prescribed Metformin and I began reviewing my food choices. I had been heavily invested in carbs and fast food for lunch. Being mostly vegetarian did not give me a pass on diabetes. In addition, I had gone from a weight of 243 pre-covid to as high as 287 in July 2021. I cut out all sugar (found in most processed foods) and restricted carbs to whole wheat. No more pretzels or chips. More vegetables, except for potatoes. I got a glucose meter and began checking my blood sugar 3-4 times a day. I could see what it looked like in the morning and see the effects of various meals during the day. I was able to exclude or include foods accordingly. My doctor got me appointments with the nutrionists at Munson. His prompt action literally saved my eyesight, my kidneys, my life. By December 10th – just 14 weeks later the results were radically different. The diabetes was under control. Weight was down 27 lbs. from the high in July. I received an email from my health plan inviting me to join their disease management program in November. At that point I had already been addressing the diabetes for 2 months and I don’t consider their action timely or effective. Real action has to resemble something more than lip service. I also received notification that I could get my test strips through their preferred Durable Medical Equipment (DME) provider. I signed up on their website in November and did not actually get test strips until February. It took 3 months! If I had waited on the plan to provide its’ benefits, I would be much sicker. I had been buying my test strips on Walmart.com since September and paying about $39. The strips using my insurance plan’s preferred provider cost me $51. I’m not seeing value in this network or its’ services.

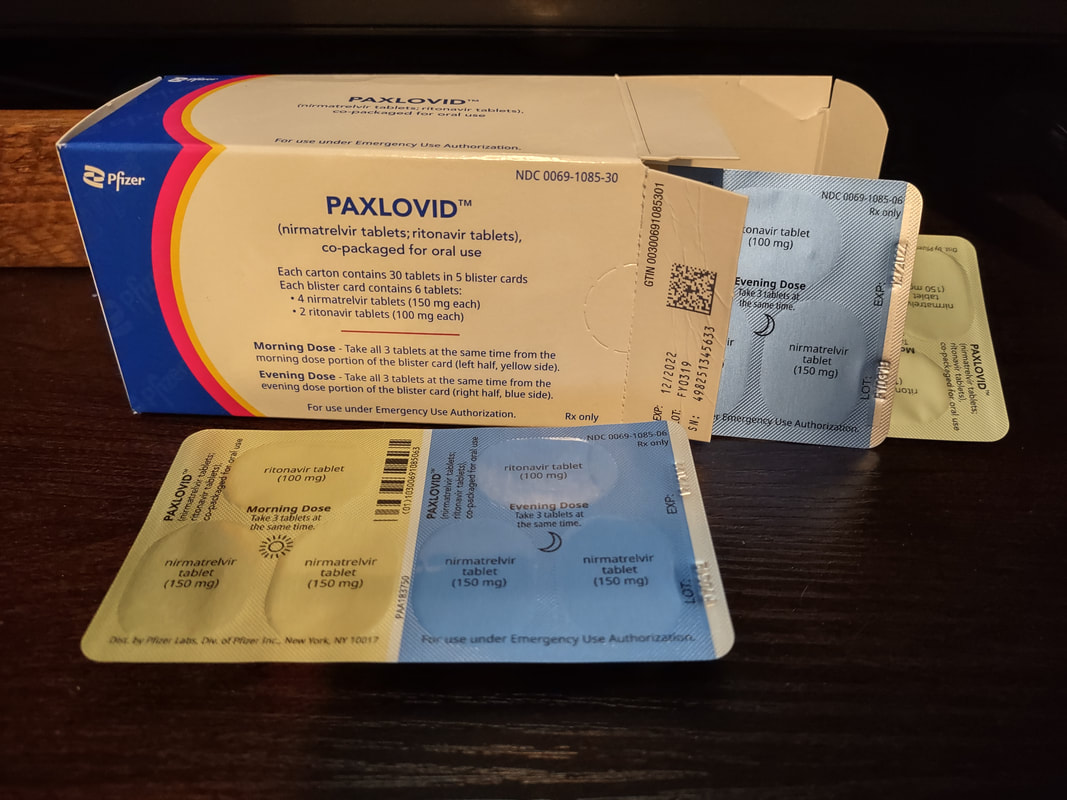

Prescriptions are a similar story. I got a new script from my doctor in October and when Meijer pharmacy texted me that it was ready, they said the price was over $400. I checked the drug on GoodRx.com and saw that I could get it for about $24. I went in and asked the pharmacy tech – “is this my discounted price using my Priority Health benefit”. She said; “yes, it is”. I said: “I would like to use this coupon on my phone”. She said; “I have a better one here taped to the cash register”. I got my script for $14! I asked her where all the extra money would go if I used my health plan benefit, she said “it’s complicated”. Ironically Priority Health began a program in January that’s supposed to check other drug prices when you use your benefit to make sure you get the lowest possible price for your drug. I think I’ll still be double checking the prices on all my health care as it relates to “network discounts and services”. I have a client who takes the $7,000/year diabetes drug advertised on the TV news. Medicare says his annual out of pocket costs should be about $7,000. The cost through the Canadian pharmacy (same drug) $1,200/year. Remember that Medicare Part D drug coverage was written for congress by big pharma. Tuesday April 12, 2022 I was experiencing aches on Monday but thought it was because I had been doing serious yard work on Sunday. By Tuesday my sinus seemed more than just seasonal allergies and I had a cough. Monday and Tuesday Covid tests were negative but by Wednesday night you could see a line on the test and by Thursday morning the test was definitely full blown positive. I had messaged my PCP on Wednesday night and called the office Thursday after 1pm. The doctor was not available and had not yet responded to the message but I knew that with my new found co-morbidities I wanted to try the monoclonal antibodies through the infusion center. They advised me to call the Munson Ask-a-Nurse hotline at 1.231.935.0951. The nurse noted that I definitely met the criteria for the therapy – but their Thursday schedule was already full. Keep in mind that they only run the clinic on Tuesday and Thursday because the supply of serum is limited and varies from week to week. Even if they had the staff to expand it, which was a possibility, there may not be enough serum. She recommended I try to get a script for the Paxlovid anti-viral pills. They were approved for emergency use authorization in January. They recommended I get a prescription from my PCP. I checked https://www.goodrx.com/conditions/covid-19/covid-pill-cost-availability and found that the drug cost somewhere between $530 and $700 and was paid in full by the Federal Government under the emergency use authorization. The site also gave me available quantities at pharmacies in my area. Old Meijer had about 38 packages while Walgreens on 31 North has 42 as of April 2. When I called back to my PCP office, they still had not heard from the doctor – but said that they did not believe they prescribed that drug. I then went to the Munson Urgent Care on Munson Avenue now know as the Foster Family Community Health Center. They said that the anti-viral prescriptions are supposed to be given by the PCP’s. Nevertheless, I did another test and they gave me the script which I took to Walgreens and had filled. They said I was the first person to get the script from them for the anti-viral Paxlovid. It’s only been about 38 hours since I started taking the pills and the difference is like night and day. Walgreen’s told me that they have had all this stuff for 2 months and I am the first person to come to them with a script. Déjà vu Well as you can guess both my wife and daughter have subsequently tested positive for covid. My daughter went through the same process on Friday as I did on Thursday. She has a different PCP – but again their office said they don’t prescribe the drug. Urgent care called in her script to Meijer (new process since yesterday) and the monoclonal antibody therapy at the infusion center is now booked out until Tuesday. Therapy should be started within 5 days in order to be effective which is why the Nurse Line recommended we get the pills. Unfortunately, my wife is too healthy and has no co-morbidities so she is not able to get the medicine. I think a lot of people could benefit from this – but the system right now is not set-up to help them. I wonder how many with co-morbidities will miss getting help because they are not as pro-active about available treatments. Conclusion Covid has turned the health care system on its head. Doors like virtual care and online services have been blown open that may have taken years to progress otherwise. Systems like the Patient Centered Medical Home (PCMH) have been slow to react and adapt. In fact, allowing primary care to languish without direction, resources, support or processes to accommodate the new normal. Resources are still and will continue to be stretched and people will continue to suffer as a result. State regulations and Health Insurance Companies have become barriers to care – directing care to monopolistic networks that have failed to adapt quickly. All of this and the footprint of big pharma have combined to provide diminished care in America and especially diminished value from the health care system. The industry needs evolution and revolution to meet the many demands placed upon it. Fortunately, we are not centralized or single payer so there is hope for the innovation needed. Obamacare has taught us that having Government shoulder the costs will not stop medical inflation or reduce costs as promised. Medicare has taught us that having choices makes the system stronger and more competitive, albeit sometimes confusing. My hope is that greater minds will get this under control. We need good cat herders, not bureaucrats or special interests calling the shots. Transparency needs to go beyond a protected panel of providers. Mindfulness of quality and cost will provide value. Always has, always will. More people are moving to the individual marketplace for health coverage. The American Rescue Plan expanded open enrollment. Open enrollment is now from November 1st to January 15th. It used to end on December 15th but delaying your decision until after December 15th will push your plan effective date to February 1st. The type of coverage you pursue will depend on your prospective adjusted gross income for your tax household.

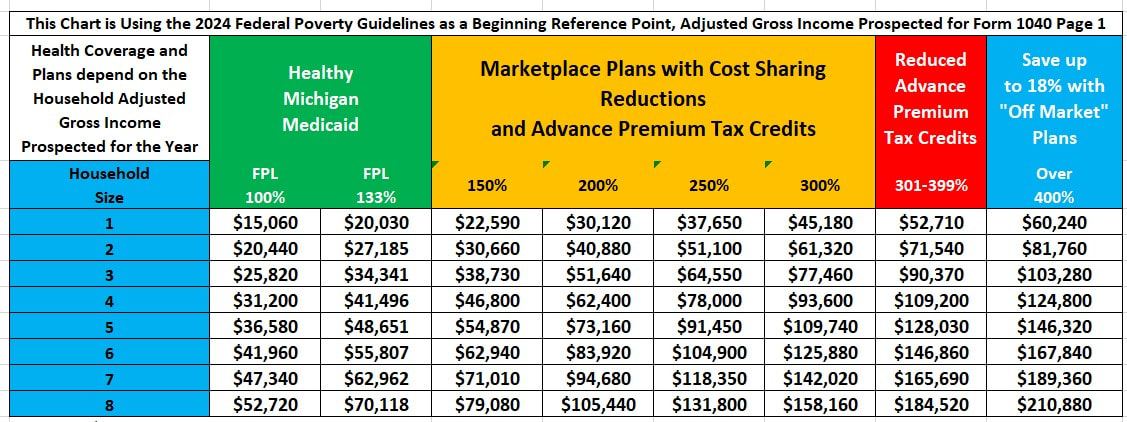

We provide free assistance helping people to maneuver the online experience and also seeing if you qualify for a special election period. If your household Adjusted Gross Income (AGI) is below 133% of Federal Poverty Level (FPL) then we can help you apply for Healthy Michigan Medicaid. Between 133 to 400% of FPL you may benefit from advance premium tax credits and/or cost sharing reductions that can get you a health plan for little or no cost. Above 400% of FPL you may be better off buying your plan "off marketplace" direct from the health carrier. Since "off marketplace" plans don't have cost sharing reductions factored into their rates, consumers can save up to 18%. The chart below gives guidance on where you may best be served. We can discuss and walk you through these options. MICHIGAN PIP Michigan’s auto no-fault law provides individuals with the following benefits under the Personal Protection Insurance also commonly known as Personal Injury Protection (PIP) portion of the policy:

· Funeral and burial expenses – limitations apply. · Survivor’s loss – consists of benefits paid to survivors and dependents of an individual who dies as a result of an automobile accident. Limitations apply to this benefit. CHANGES TO MICHIGAN MEDICAL/ALLOWABLE EXPENSE COVERAGE For policies issued or renewed beginning on July 2, 2020, Michigan drivers will be able to select their preferred level of Medical/Allowable Expense coverage under PIP. Based on an individual’s eligibility and specific needs, the individual will be able to select from the following options: OPTIONS AVAILABLE TO EVERYONE > Unlimited (with Michigan Catastrophic Claims Association involvement) > $500,000 > $250,000 OPTIONS AVAILABLE TO ELIGIBLE INDIVIDUALS WITH QUALIFIED HEALTH COVERAGE. WHAT IS QUALIFIED HEALTH COVERAGE (QHC)? Qualified health coverage is health or accident insurance coverage that does not exclude or limit coverage for injuries related to auto accidents and has a deductible of $6,000 or less per person. > $250,000 PIP Exclusion WHAT IS IT? If an individual qualifies for and chooses this option, and they are injured in an automobile accident, their medical benefits will be covered by their QHC provider. Individuals who purchase this option will not be eligible for any PIP medical/allowable expenses. WHO IS ELIGIBLE? Insureds who have QHC (see red note above) and their spouse and/or resident relative(s) in the same household, who have QHC or are enrolled in Medicare Parts A and B. If not all household residents are eligible, it is still possible to elect this option, with the exclusion applying only to eligible individuals. OPTION AVAILABLE TO ELIGIBLE INDIVIDUALS WITH MEDICAID > $50,000 Medical/Allowable Expense - Medicaid Only WHAT IS IT? $50,000 Medical/Allowable Expense coverage option for Medicaid recipients. WHO IS ELIGIBLE? Insureds who are enrolled in Medicaid. However, a spouse and/or resident relative(s) in the same household must also be enrolled in Medicaid, be enrolled in Medicare Parts A and B, have other PIP Allowable Expense coverage, or have QHC. OPTIONS AVAILABLE TO ELIGIBLE INDIVIDUALS WITH MEDICARE > Medical/Allowable Expense Opt-Out – Medicare Only WHAT IS IT? Complete opt-out of Medical/Allowable Expense coverage for Medicare recipients. WHO IS ELIGIBLE? Insureds who are enrolled in Medicare Parts A and B. However, a spouse and any resident relative(s) in the same household must also be enrolled in Medicare Parts A and B, have other PIP Medical/Allowable Expense coverage, or have QHC. Insureds will be required to provide documentation showing that they, their spouse, and any resident relative(s) are eligible in order to elect this option. *Please see the No-Fault Act for complete details. This summary is being provided for general information purposes only. Subject to regulatory approval. Coverage is subject to all policy terms, conditions, exclusions and limitations. The season is upon us. The Annual Election Period for Medicare begins October 15th and ends on December 7th. Open enrollment on the Federally Facilitated Marketplace for under age 65 plans will be from November 1st through December 15th. We are set-up to walk you through the process so you can see ALL the available options. We do not charge for this service and we will not call you on the phone unless you ask. Call, text or email for your free annual review today. The Medicare.gov website has been updated and it remains to be seen what additional confusion may be caused by the changes. You can see the original article in the Free Press by clicking the button below.

Jim was recently baptized at my church. I would go to his house every Wednesday and he would be waiting for me. We would go to my house and eat a wonderful meal prepared by my wife. We always gave Jim enough leftovers for 3 or 4 more days. We would then do a devotional study just to stay in the Word. He was diabetic and had vision issues - but wasn't afraid to hold the book right up to his face so he could read. One day I went to Jim's and he wasn't waiting and didn't answer the door. I went inside and found him. He was dead. He had not been taking his insulin or checking his blood sugar because he didn't have money for insulin. Insulin is a drug that has been around since the 1920's. My great grandfather lost both his legs because of diabetes, but when insulin arrived on the scene it kept him alive for another 35 years. His father also had diabetes and eventually died from gangrene. The cost of insulin is literally pennies a dose but I now have clients paying up to $5,000/year for their insulin. Executives from the pharmaceutical companies recently appeared before congress to try and explain why this drug has tripled in price over the last decade. It reminds me of the EpiPen crisis a couple of years ago. Suddenly the lifesaving medication was $600/dose when is had been $60 for many years. Corporate greed in America is literally killing people. I dream of waking up one morning only to discover that the big pharma executives and their related venture capitalists were rounded up during the night and are now staying rent free in Gitmo. I don't think anyone in America would complain. Even the ACLU would be hard-pressed to make their case. A recent popular TV sitcom made a lot of jokes at the expense of big pharma. The Medicare couple would split the drugs up each month between the two of them because they didn't have enough money for full proper prescriptions. When you think of the advertisements that surround the evening news you realize that the networks rely on big pharma for a lot of their revenue. It was not surprising when the sitcom was taken off the air. I don't think political correctness was the real reason. I listened to a spokesman explaining why Americans need to pay more than anyone else in the world for our drugs. If we don't we'll die because of a downturn in research and development. This is fear mongering of the first order. We just need corporate America to justify the pillaging of senior citizen bank accounts. I say it's time to round them up and set an example. |

Contact Us(231) 932-1900 Archives

September 2022

Categories

All

|

Navigation |

Connect With UsShare This Page |

Contact UsinsureTC Michigan Insurance Agency

945 E 8th Street Suite 1 Traverse City, MI 49686 (231) 932-1900 Click Here to Email Us |

Location |

RSS Feed

RSS Feed