0 Comments

This article from NPR sums up the confusion surrounding auto rates that help make Michigan auto insurance some of the most expensive in the country. This in spite of reform that was supposed to bring rate relief. "Michigan's 2019 auto no fault law banned the use of credit scores in setting car insurance rates, but not the use of insurance scores."

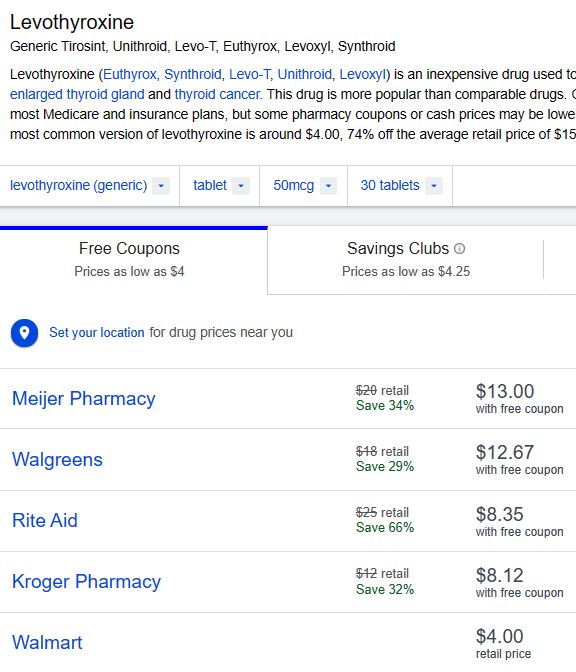

"Insurance scores and credit scores are virtually identical methods of determining if someone has good or poor credit." From our experience we still need enumeration (a client's Social Security Number) and the carriers do a soft ping on credit. While it may NOT be used to determine rates it will be used to determine available payment options. Enumeration is also required for health insurance since the homeland security act was signed by President Obama in 2008. Michigan Personal Injury Protection (PIP) is a huge health insurance benefit and is applied to everyone in a household unless everyone is on Medicare. Medicare eligible people have the option to opt out of PIP - but that may be a bad idea if they have any assets worth protecting. HealthCare.gov Offers Low-Cost, Quality Health Coverage to People Losing Medicaid or CHIP: Here’s What You Need to Know to Avoid a Loss of Coverage

Millions of people across the country continue to be at risk of losing health coverage over the next several months. Medicaid is a lifeline for millions of children, parents, seniors, people with disabilities, and so many others. What should people do to keep their health coverage? If you still have Medicaid or CHIP, make sure your contact information is up to date and check your mail for a renewal form from the state Medicaid agency. Fill out the form and return it immediately to avoid a loss of coverage. Why is this happening now? During the COVID-19 pandemic, states were generally allowed to temporarily stop renewals for Medicaid and CHIP. This kept people from losing their health coverage. On December 29, 2022, the Consolidated Appropriations Act (CAA) was signed into law and required states to return to normal operations by restarting their eligibility reviews. Millions of adults and children continue to be in jeopardy of losing their Medicaid or CHIP coverage. What if I am no longer eligible for Medicaid or CHIP? If you have lost Medicaid or CHIP, visit HealthCare.gov to see if you are eligible to enroll in a low-cost, quality health plan. Due to the Inflation Reduction Act, enhanced financial help is available to purchase health coverage through HealthCare.gov. In fact, 4 out of 5 customers can find a plan for $10 or less per month with financial help. What you pay is based on your age, your family size, your household income, where you live, what plan you choose, and other factors. What do the health insurance plans available on HealthCare.gov cover? Plans available on HealthCare.gov offer a wide range of benefits and comprehensive coverage. All medical coverage plans at HealthCare.gov cover essential health benefits, including preventive services like annual checkups, hospitalizations, prescription drugs, birth control, doctor’s visits, emergency care, and more. All plans at HealthCare.gov are prohibited from excluding coverage based on preexisting conditions. Marketplace health plans are offered by private insurance companies that offer quality coverage. Where can I get application assistance? You can get application assistance from a licensed agent or broker who is registered with the Marketplace. Agents and brokers are essential partners in connecting consumers with health coverage during the unwinding period. Agents and brokers provide enrollment functions and assist with transitions in coverage so that consumers like you can stay enrolled in coverage. For instance, agents and brokers can help you correctly fill out the Medicaid/CHIP coverage questions on the Marketplace application to see if you may still be eligible for Medicaid/CHIP coverage. If you are found to be ineligible for Medicaid/CHIP coverage, you may be able to enroll in a low-cost, quality health plan through the Marketplace with the assistance of agents and brokers. Consumers with questions about their coverage or who would like help enrolling can contact insureTC.com at 231-932-1900. When can I apply? Although the annual Open Enrollment Period ended on January 16, 2024, you may still be able to apply for Marketplace coverage or change your existing plan if you experience life changes that qualify you for a Special Enrollment Period. Losing Medicaid or CHIP coverage is considered a qualifying life event for a Special Enrollment Period! Contact insureTC.com at 231-932-1900 to determine if you qualify for a Special Enrollment Period and get help with applying for coverage or updating your existing plan. Additional Resources: https://www.insuretc.com/health-insurance.html https://www.insuretc.com/medicaid--more.html We have been fortunate in Northern Michigan with stable carriers that follow the rules. As new carriers enter the market it will be important to watch star ratings and listen to the experiences people have had with their plan. As an independent agency we hear from about 600 people each year sharing their experiences. When someone wants a less than optimal plan - they can have it - but we will disclose the known pitfalls. Post-covid we have enough barriers to access to care. When a carrier puts up additional hoops to jump through as a cost savings tool - it is simply unacceptable. I want a healthy plan that is actively addressing fraud, waste and abuse and I also want access to care.

Fortunately consumers can vote with their feet when it comes to Medicare Advantage. There is the annual election period (AEP) every year from October 15 - December 7th. Consumers also have what we call the "do over" window which is an open enrollment window (OEP) from January 1st - March 31st in case they have made a bad decision during AEP. www.politico.com/news/2023/11/24/medicare-advantage-plans-congress-00128353 FOR IMMEDIATE RELEASE: September 12, 2022

(LANSING, MICH) September is Life Insurance and Annuity Awareness Month and the Michigan Department of Insurance and Financial Services (DIFS) is reminding Michiganders that it is available to answer questions pertaining to this vitally important coverage. "Purchasing life insurance or an annuity is an investment in the future. These products not only provide protection for your loved ones, but they can serve to build generational wealth and secure financial stability for your children, grandchildren, or other beneficiaries," said DIFS Director Anita Fox. "Life Insurance and Annuity Awareness Month is a great reminder to look into this coverage and ensure that your family is financially protected. Through our call center, DIFS stands ready to help consumers understand their life insurance or annuity benefits. Those who cannot find important records after the death of a loved one can take advantage of DIFS’ free Life Insurance and Annuity Search Service." Purchasing life insurance can help provide peace of mind that your loved ones will have the financial resources they need to pay daily bills, cover end-of-life expenses, or pay medical bills if tragedy strikes. Life insurance may also be a key component of a family’s strategy for long-term financial or retirement planning, paying for college, and building generational wealth. Recent studies show that approximately 65% of Americans do not buy life insurance simply because they don’t understand how to buy a policy and are unsure what type of coverage they need. To help make this process easier, DIFS helps Michiganders with life insurance or annuity concerns by:

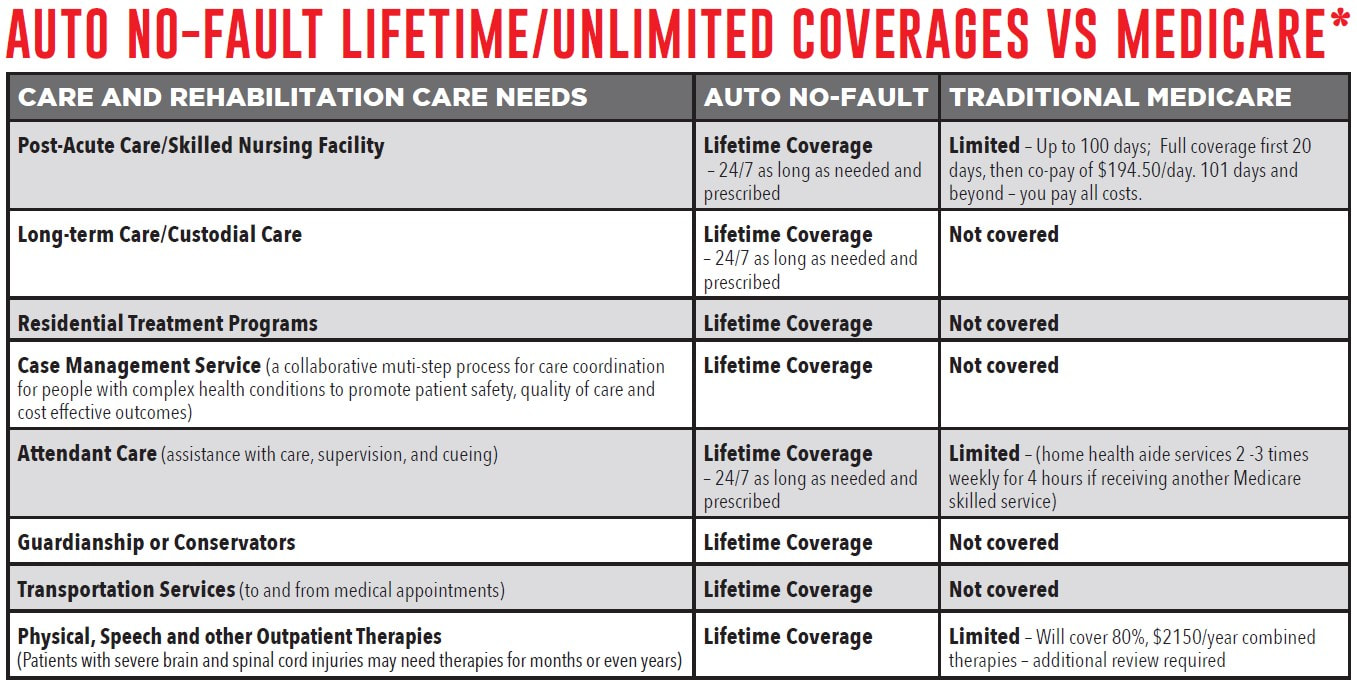

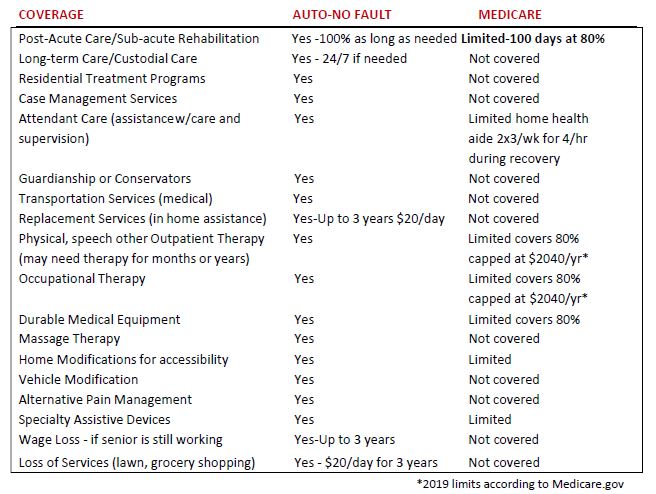

The mission of the Michigan Department of Insurance and Financial Services is to ensure access to safe and secure insurance and financial services fundamental for the opportunity, security, and success of Michigan residents, while fostering economic growth and sustainability in both industries. In addition, the Department provides consumer protection, outreach, and financial literacy and education services to Michigan residents. For more information, visit Michigan.gov/DIFS or follow the Department on Facebook, Twitter, or LinkedIn. The short version is that if you have Medicare, but are not eligible for Medicaid and have any assets worth protecting, we recommend you keep your unlimited PIP (Personal Injury Protection). The chart below helps to show why. In 2019, dramatic changes were made to the Michigan auto insurance law. Drivers now are faced with a number of choices in Personal Injury Protection coverage (PIP), that if selected, could have devastating consequences should they, or their loved ones, suffer serious injury in an auto crash. Seniors now have the option to completely opt-out from no-fault allowable expense PIP benefits if they satisfy the following two conditions: 1) the person is covered under Parts A and B of Medicare; and 2) the person’s spouse and any resident relative has Medicare “qualified health coverage,” or has no-fault PIP coverage under a separate policy. Seniors who select this option are not entitled to coverage through the Assigned Claims Plan (ACP) when injured as an occupant of a motor vehicle, but are likely entitled to ACP coverage when injured as a non-occupant or pedestrian, and there is no other insurer from which to recover PIP benefits. ACP medical benefits are capped at $250,000. Before you consider this option, it is vital to understand what benefits are not available under Medicare, but may be needed should you be severely injured in a crash. Below is a table identifying how the care and rehabilitation needs of a vehicle crash survivor are covered under Michigan’s auto no-fault lifetime/unlimited medical expense coverage vs Medicare. * With no MSP or Supplemental Coverage | *2022 limits according to Medicare.gov OTHER CONSIDERATIONS:

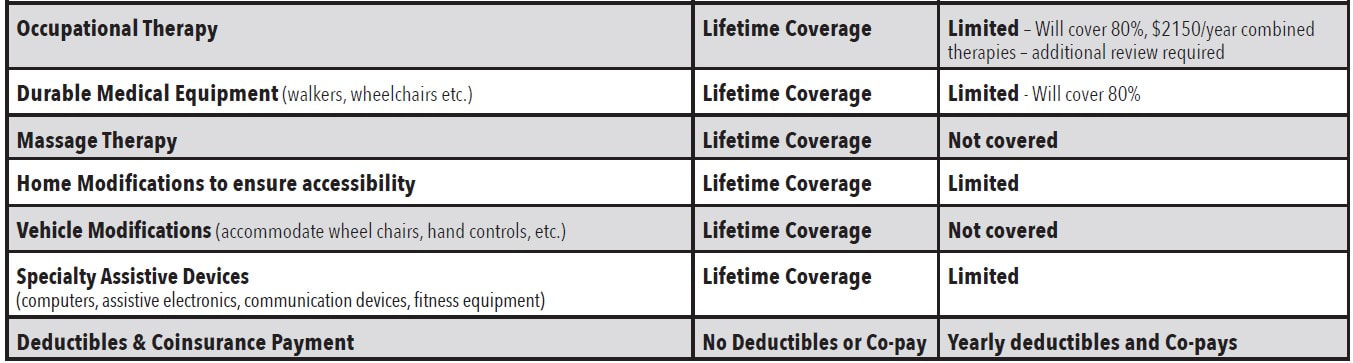

• Care options may be limited since not all specialists participate with Medicare • Seniors are more likely to have previous medical conditions such as Parkinson’s Disease, stroke, osteoporosis, diabetes, arthritis and heart disease that may complicate and lengthen the recovery process from an auto accident. • If the senior received a settlement from an accident claim, Medicare is entitled to recover the cost of any medical expenses paid to the claimant. Now that the 2022 plans and prices are available on Medicare.gov we have an opportunity to see what Medicare reports as the retail price on prescription drugs. Every year we find new and exciting examples of seniors being taken advantage of through pharmaceutical over pricing. Remember that the Retail price reported by Medicare is the retail price of the drug reported to them by the pharmaceutical company. Medicare is not allowed to question that price, shop that price or offer alternative pricing. This is the law passed by congress that took effect in 2006 and was written with the help of the pharmaceutical companies. There have been attempts to allow the government to negotiate on behalf of seniors but there is a strong lobby protecting special interests. All attempts to change the status quo have failed for 15 years. A recent example is Levothyroxine Sodium which is the generic version of Synthroid. The Medicare price for 30 pills is $152.48 but a check of GoodRx shows that you can get the same number of pills for $4 at Walmart. Why is Medicare 38 times higher that the street price? Seniors who don't shop their drugs will be taken advantage of by their government. Medicare has many rules in place to protect seniors but they fall short where big pharma is concerned. Caveat Emptor is the lesson here - let the buyer beware or more appropriately be aware. Know the street price of your drug before you go to the pharmacy. Be prepared to demand a fair price even if it means paying cash instead of a copay. When paying cash realize that any amount you spend will not count towards your total drug expenditure for the year which may make it more expensive to enter into the catastrophic level of coverage provided for under part D of Medicare.

In early March I finally had my turn to get the shot. As I lined up outside the Hagerty Center I was pleasantly surprised - in and out in 25 minutes. That included all the paperwork and waiting time after I received the vaccine. mRNA vaccines are new but they have been known about and studied for decades. They were long recognized as a preferred way to deliver a vaccine in part because of their ability to handle some mutations. Unfortunately they were too expensive to manufacture and distribute so the idea just sat on the shelf.

That is until the pandemic. When the country was put on a war footing, with virtually unlimited funding, the opportunity opened up to make them available. Now that the cost barrier has been broken we have access to new and better vaccines. The benefit could be as revolutionary as penicillin and comes at a time when it was beginning to look like virus's and germs would regain the upper hand. Herd immunity is now within reach and the 70% number has been bandied about but I believe 80% would be more effective. Herd immunity is based on antibodies and there are only two ways to get them. Get a vaccine or get the disease. I know many young people have forgotten the scourges and deaths that were the result of smallpox, diphtheria, polio, scarlet fever and gangrene. My family has experienced all of these and we only need to look back 5 generations to see it. Up to now covid costs have been borne by insurance companies and the government with no patient liability. That will not remain the case. In only a few months deductibles, copays and out-of-pocket maximums will begin to apply. Someone who has symptoms and tests positive should plan on at least 2 weeks of lost wages. Set aside about $1,500.00 so you can have groceries and a roof over your head. If you end up hospitalized it will only take 2 days to run through your deductible and out-of-pocket limit on most plans. Plan on another $6,900.00 there. All told relying on the sickness to give you immunity will expose each person to almost $10,000.00 in potential costs. It may be higher for families or couples. The average cost for a patient hospitalized for Covid is $317,000.00. This is more than even serious coronary bypass surgery. The unseen cost is the toll it can take on heart, lungs, kidneys and brain health. Life expectancy has been shortened and it will be decades before the full impact is known. Weakened systems may take years to fail so those costs are kicked down the road. In 1902 at the age of 7, my grandmother lost all her hair when she had scarlet fever and diphtheria at the same time. She recovered and her hair came back - but the heart murmur was with her the rest of her life and was her eventual cause of death over 70 years later. Everyone will eventually play a part in herd immunity. The question is how much are you willing to pay for it? OTHER CONSIDERATIONS:

• With PIP, there are no deductibles or co-pays. With Medicare, you are responsible for all applicable deductibles and copays. • Not all medical specialists participate with Medicare. • Important to note: if a Senior Citizen receives a settlement from an accident claim, Medicare is entitled to recover the cost of any medical expenses paid to the claimant. When health care reform via the Health Insurance Marketplace was first introduced it included a fee called the Patient Centered Outcomes Research Institute Fee. It was originally identified as a best practices panel that would be appointed to make sure finite health care dollars were wisely spent and not wasted on procedures that would not appreciably extend quality of life. Immediately opponents identified it as a death panel that would ration healthcare. Physicians can best answer if this is the case now that some of the higher cost specialties have had the government change how they practice medicine via quality measures. In the meantime the fee or tax is still being collected to fund the PCORI.

The IRS has announced that the 2019 calendar plan year Patient-Centered Outcomes Research Institute Fee (PCORI) for the July 2020 filing will be $2.54 per covered individual (up from $2.45). As a reminder, health reimbursement arrangements (HRAs) are considered self-funded health plans and are therefore subject to the PCORI fee. In IRS Notice 2020-44, the IRS has now released the fee for plan years ending on or after October 1, 2019 and before October 1, 2020, which includes 2019 calendar plan years that will report and pay the PCORI fee this July. For additional information and help determining your PCORI fee, check out this PCORI fee calculator here. |

Media Inquiries(231) 932-1900 Archives

May 2024

Categories |

Navigation |

Connect With UsShare This Page |

Contact UsinsureTC Michigan Insurance Agency

945 E 8th Street Suite 1 Traverse City, MI 49686 (231) 932-1900 Click Here to Email Us |

Location |

RSS Feed

RSS Feed